RECOMMENDATION FOR TEENAGERS TO NOT USE CREDIT CARDS WASTEFUL

Paying for Credit Credit cards work on compound interest. When you see other students use credit cards to buy things.

Pdf Are College Students At Greater Risk Of Credit Card Abuse Age Gender Materialism And Parental Influence On Consumer Response To Credit Cards

In 1996 twenty-something consumers owed an average of 2400 on their credit cards nearly triple what they owed in 1990 according to research by Claritas Inc a marketing research firm in Virginia.

. The lecture part is one of the most critical part in giving credit cards to teenagers. Work for Teens and. Identity theft and credit card fraud are serious problems and can damage your credit and threaten your financial security.

Always keep your information secure. Credit cards are not free money. If youre not too keen on handing your kids cash every day making them an authorized user on your credit card is a.

This is gonna result in totally unused wasteful accounts. Best credit card for teens 18 and over Discover it Secured Credit Card Credit Card. Teach Kids About Charge Cards.

Just cutting them up is not sufficient. In many cases student credit cards will have more flexible credit requirements than other unsecured cards meaning your teens lack of a credit history may not stop them from qualifying. There are negatives that come along with it.

Teens and Credit Teacher Reference 1 Lesson 1. Before you set up your teen with their first credit card you should review some of the rules and regulations concerning young people and credit. Kids know that banks.

That is why credit cards take such a long time to pay off. There is no book that would advise parents to not issue the cards. For example your child may have a 1000 credit limit allowing him t.

If your teen is under the age of 18 their only option is becoming an authorized user on one of your accounts. Late 40s here looking to better my rewards as I rebuild my credit. Learning to use credit is a fundamental part of growing up.

Teach Kids About Charge Cards Money ABCs Credit cards allow your child to pay for things up to a certain credit limit a fixed dollar amount set by the credit card company. The Discover it Secured Credit Card Credit Card offers one of the best rewards programs of secured cards out there. In your teenage years you should be getting ahead financially not falling behind.

This is what I want teens to know about how credit cards work before they go off to college. If your teen is under the age of 18 then they cannot have their own card. That means a percentage is added to both the principal the amount of your loan or purchase and to the interest that has already been added to the principal amount.

A line of credit is not income its debt. Its not extra money so you can spend more than you earn. Teenagers more youthful than 18 can just get a Mastercard if their guardians co-sign for itCredit card organizations are courting progressively more youthful clients who are very anxious to streak their plastic.

In both cases you as a parent are being stupid. I remember the teen years everything is about status. Somehow our teens are being taught that a credit card is a status of adulthood.

Teens should avoid using one credit card to pay for another. If payments of 75 were made monthly to. This was my first credit card and I.

Parents make the decision so parents make the lecture. Just so you can also open up a credit card. Credit card companies should not target college-age students and low-income consumers because of their lack of financial stability.

The card issuer charges interest. To get a credit card under their own name your teen has to be at least 18 years old. Owning a credit card does not make you cool.

And with responsible card use over their college years your teen can graduate with a healthy credit profile already established. By definition theyre credit cards meaning that when you use them youre borrowing money from the issuer. Given the decision in the middle of money and credit teenagers progressively love to blaze plastic.

The decision lies on the parents. Cancel unused and unnecessary credit cards. For example teens who do not use their credit cards responsibly can potentially ruin their credit at a young age.

You will have to add them as an authorized user to one of your cards. CREDIT PROFILE Current credit cards. Its not a debit card.

You are not teaching your 16-year-old child to spend responsibly when you give him or her a credit card any more than you are teaching gun responsibility by letting him sleep with a loaded automatic weapon with the safety off. A credit card offer in the mail does not make you special or important. Card Recommendation Request Template Used.

If you have a credit card never give out your number or lend your card or info to anyone else. Giving credit cards to teenagers will require deep thinking and critical analysis. It can be used to help manage cash flow but it can also be a heavy burden to carry.

Parents can teach responsible use of credit cards and other financial products such as bank accounts to kids by talking to them at an. People with common sense dont give 16-year-olds beer to teach them how to hold their. With these you still have to pay back the balance one you charge something.

These banks are desperate for your business and will happily give you one or more credit cards without you having to open up a checking account also. Youll earn 2 cash back at Gas Stations and Restaurants on up to 1000 in combined purchases each quarter 1 unlimited cash back on all other purchases -. Teenagers should notify the card issuer when they move in order for the account statements to be promptly delivered to the correct residence.

Pdf Are College Students At Greater Risk Of Credit Card Abuse Age Gender Materialism And Parental Influence On Consumer Response To Credit Cards

Pdf Students Saving Attitude Does Parents Backgroundmatter

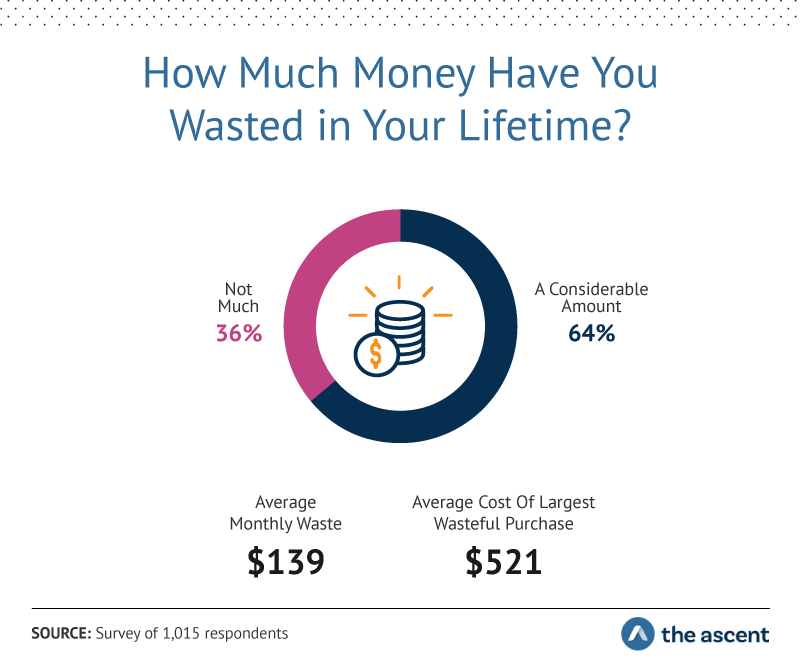

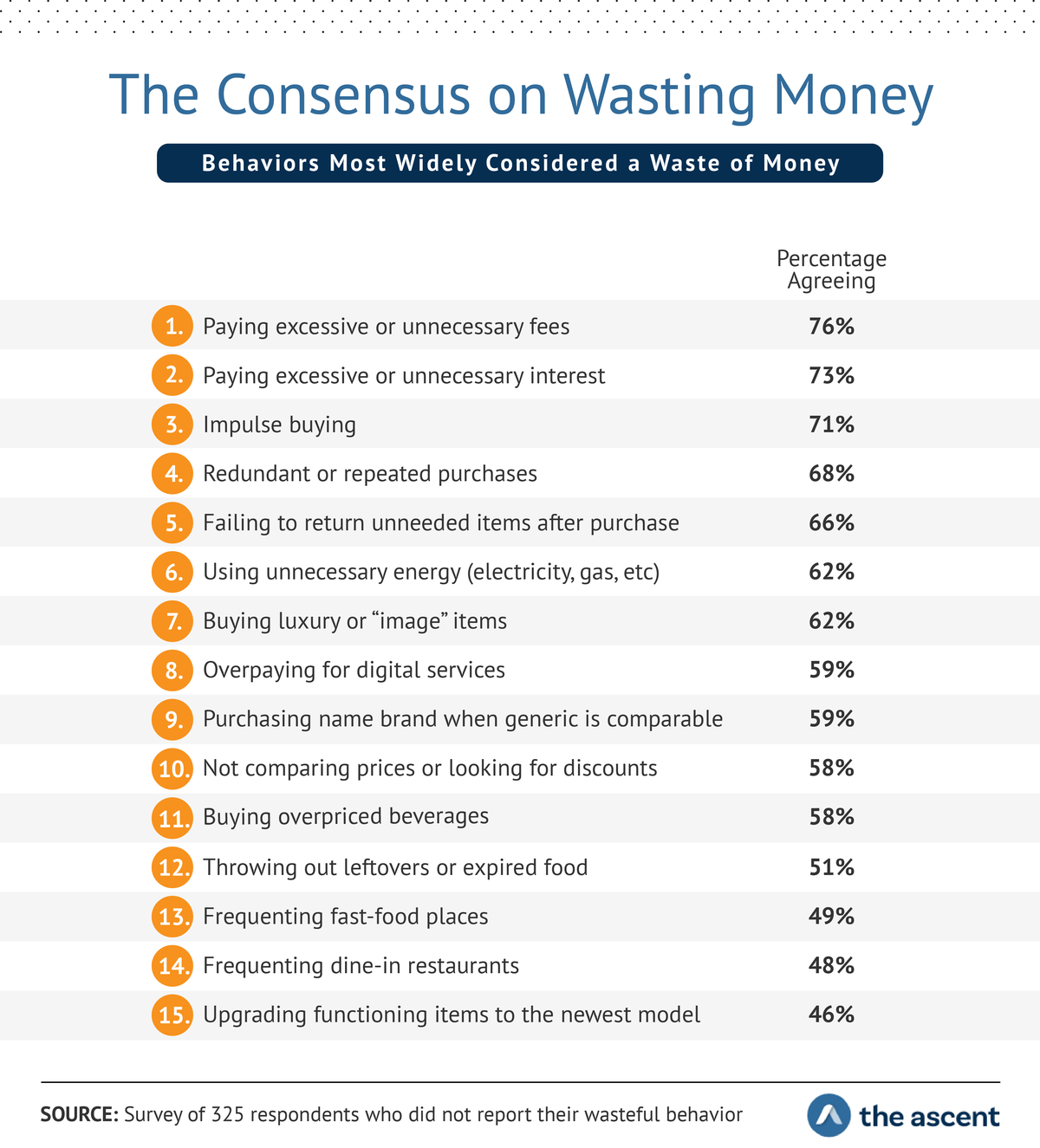

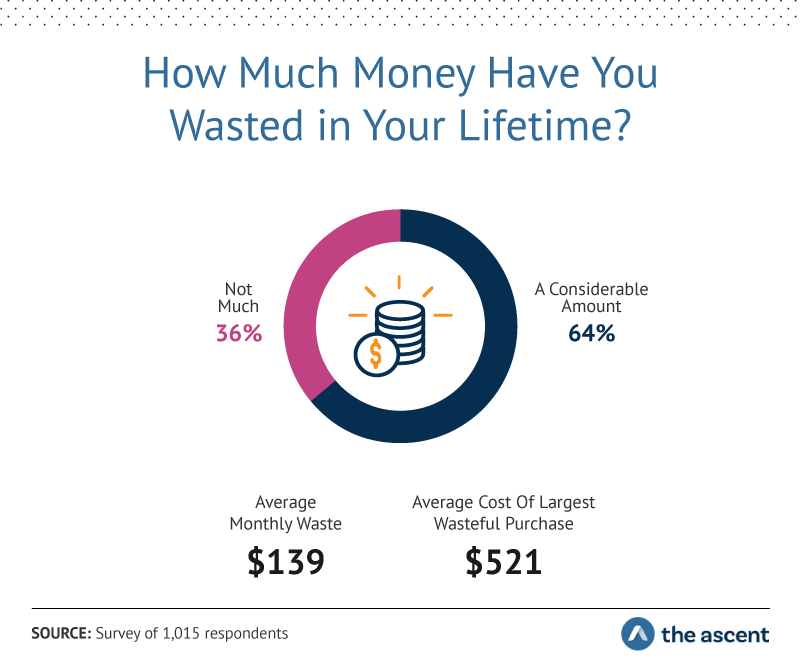

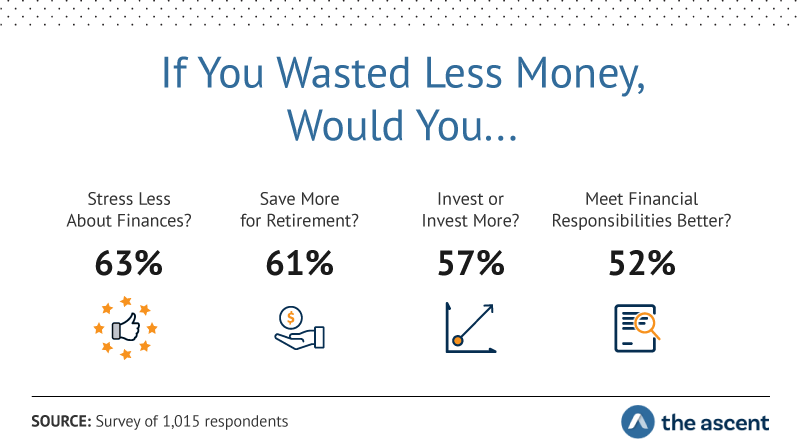

Study The Most Wasteful Spending Habits Among Americans

Study The Most Wasteful Spending Habits Among Americans

/GettyImages-1158136587-4bccd30dafc34615b4d84237207ebed2.jpg)

Getting Your Kids Their First Credit Card

Study The Most Wasteful Spending Habits Among Americans

What To Do When Your Teenager Is Wasting Money Personal Finance Us News

Study The Most Wasteful Spending Habits Among Americans

Pdf Are College Students At Greater Risk Of Credit Card Abuse Age Gender Materialism And Parental Influence On Consumer Response To Credit Cards

0 Response to "RECOMMENDATION FOR TEENAGERS TO NOT USE CREDIT CARDS WASTEFUL"

Post a Comment